In today’s interconnected world, smart home systems have become an integral part of our lives, offering convenience and efficiency. However, these systems also introduce new layers of complexity when it comes to cybersecurity. Personal cyber insurance plays a crucial role in safeguarding these devices and ensuring the safety of your home environment.

Understanding Personal Cyber Insurance

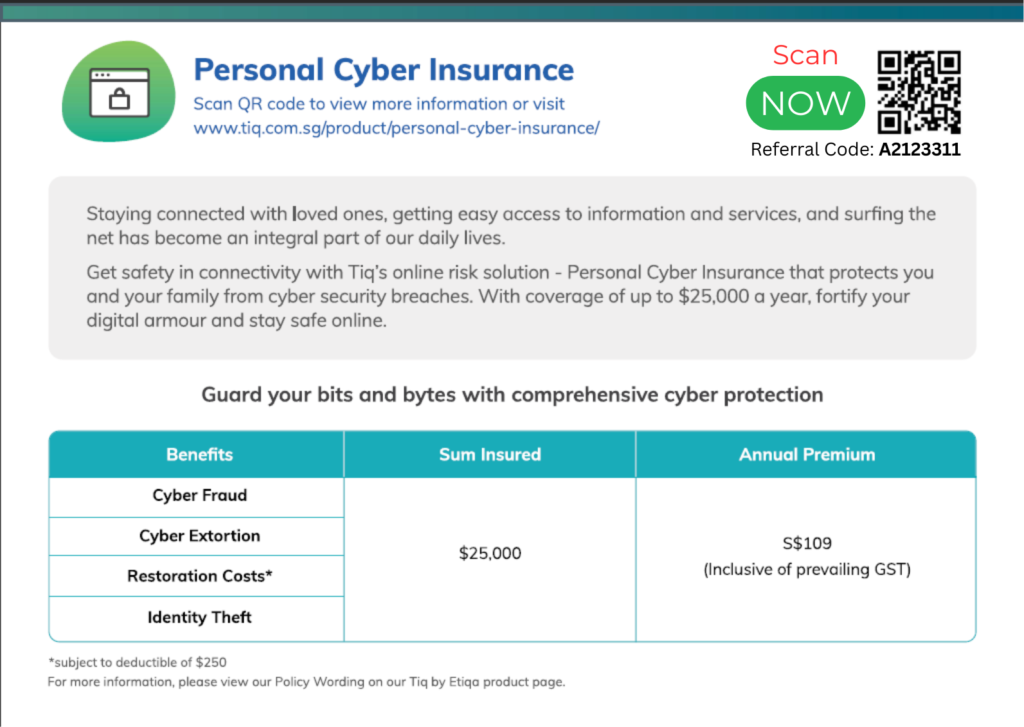

Personal cyber insurance is designed to protect against various cyber threats that can affect individuals and families. It typically covers losses related to data breaches, identity theft, phishing attacks, and malware infections. Here’s a breakdown of what it usually includes:

- Data Breaches: Protection against unauthorized access or misuse of personal information.

- Phishing Attacks: Coverage for potential financial losses from fake emails or messages seeking sensitive information.

- Identity Theft: Safeguarding against unauthorized use of your personal data by cybercriminals.

Why It’s Essential for Smart Homeowners

- Vulnerability to Hacking

- Smart home devices often rely on internet connectivity, making them potential targets for hackers. If a hacker breaches into one device, they can gain unauthorized access to others in the same network, leading to widespread security issues.

- For instance, gaining control over your thermostat app could allow a hacker to manipulate temperature settings without your knowledge, posing risks to residents with special needs or elderly individuals.

- Preventing Data Breaches

- If smart home systems are compromised, there’s a higher risk of unauthorized access to other devices in the network. Personal cyber insurance can help mitigate potential financial and operational losses from such breaches.

- Mitigating Phishing Attacks

- Hackers often use phishing emails pretending to be from trusted entities like your smart home provider to steal sensitive information. Having insurance can protect you from the financial repercussions of such attacks.

- Zero-Day Exploits

- Cyber threats are constantly evolving, and new vulnerabilities emerge before they can be exploited. With proper insurance coverage, you’re protected against potential zero-day exploits that could compromise your smart home system.

- Peace of Mind and Security

- For smart home owners, the constant monitoring required to maintain security can be overwhelming. Personal cyber insurance offers peace of mind by providing comprehensive protection without the need for constant vigilance.

Benefits of Personal Cyber Insurance

- Financial Protection: safeguarding against potential financial losses from cyber threats.

- Peace of Mind: Ensuring your smart home is secure, reducing anxiety about potential breaches or attacks.

- Liability Coverage: Protecting against costs associated with defending your smart home system against malicious actors.

Conclusion

While personal cyber insurance might seem like an additional precaution, it’s essential for smart homeowners. The interconnected nature of smart home devices makes them more vulnerable to cyber threats, and the potential consequences of a breach can be severe. By obtaining personal cyber insurance, you can enhance your security, protect against various cyber threats, and enjoy peace of mind while managing your smart home effectively.